Why waiting to

invest in

sustainability

is the wrong choice

A green recovery is important to investors, employees and the future of your organization

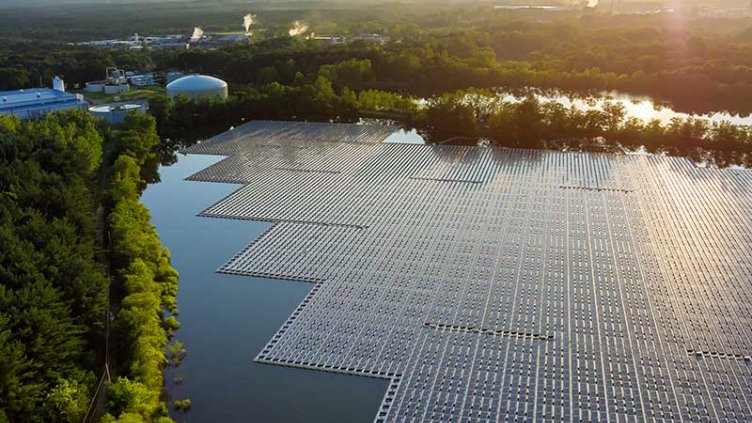

As the world shut down due to the COVID-19 pandemic, the earth took notice of clearer air, cleaner water, wildlife returning to their natural habitats and more.

Now there’s a growing desire to reopen the world in a way that respects ourselves, our society and our environment, as well as to change our behaviors for the long term. This is what the “green recovery” movement is all about: getting back to business without compromising the opportunity we’ve been given.

Consumers, employees and investors alike view sustainable practices as a priority and expect organizations to do the same. With nearly 40% of total global carbon emissions attributed to real estate, the occupants of the world’s buildings have a tremendous opportunity — and responsibility — to put sustainable practices into place immediately.

And the business case for sustainability has never been stronger. Governments and businesses across the world are prioritizing climate action in their recovery from COVID-19, and the number of commitments to reach net zero emissions has doubled in less than a year, according to the United Nations Framework Convention on Climate Change.

Sustainability isn’t a fad and data proves its growing importance. This is why it’s important to distinguish myths from reality when it comes to determining the right time to invest in sustainability. While some organizations might consider deprioritizing sustainability due to the current pandemic and resulting economic climate, doing so is a missed opportunity to position themselves for post-pandemic success.

For investors and shareholders:

Today's C-level leaders and boards of directors are facing increased pressure from shareholders to tackle sustainability initiatives and prove they are doing so. The same goes for real estate investment managers: They’re feeling amplified pressure since real estate is at the core of their business. Organizations that don’t make significant strides with their sustainability program risk losing investor dollars.

Investors are increasingly looking for companies to prove they’re taking steps to become more sustainable and resilient, going beyond financial disclosures during the review process. According to a 2020 survey of investors, nearly all (98%) respondents said they review, formally or informally, nonfinancial disclosures related to the environmental and social aspects of a company’s performance. Additionally, 72% of respondents said they usually conduct a structured, methodical evaluation of nonfinancial disclosures, up 45 percentage points from 2016.

Investors also are growing their understanding of environmental, social and corporate governance (ESG) reporting. When deciding on investments, 67% surveyed said they make “significant use” of ESG disclosures that are shaped by the Task Force on Climate-related Financial Disclosures (TCFD), the majority of whom indicated it has a significant impact on their decision making.

Real estate investors are also concerned about their portfolios’ exposure to various physical risks that could occur as a result of climate change, given the rising rate and severity of natural disasters. Some 820 natural disasters occurred in 2019 — a number has more than tripled in the past three decades. The losses in 2019 alone hit $150 billion, with insured losses about a third of that. The average number of annual U.S. climate or disaster events with losses exceeding $1 billion was 18.8 between 2015 to 2019, compared to 11.9 in the 2010s, 6.2 in the 2000s, 5.3 in the 1990s and 2.9 in the 1980s, according to the NOAA National Centers for Environmental Information. Sustainable practices can help reduce the severity and frequency of these disasters.

For employees:

Americans are more concerned than ever about global warming, with a record 66% connecting it to human activity. And more than two-thirds of people globally agree that it’s caused mostly by human activity. It’s not surprising that organizations committed to sustainability make more desirable employers than those who are not.

According to a 2019 Fast Company survey, more than 70% of employees at large U.S. companies said they are more likely to want to work for a company with a robust environmental agenda, and a similar percentage said it would make the difference between choosing a long- or short-term tenure there. One out of 10 even said they’d take a $5,000 to $10,000 pay cut to work for an environmentally responsible company.

Millennials, who will make up 75% of the workforce by 2025, value a sustainability agenda more than older generations. Nearly 40% of them (vs. fewer than 25% of Gen X and only 17% of Baby Boomer respondents) confirm they’ve chosen a job in the past because the company performs better on the sustainability front than an alternative business.

Talent attraction and retention is a hot-button issue with today’s CEOs. Regardless of a company’s location, size or industry sector, finding and retaining talent is the number-one internal stress point globally for CEOs and the C-suite in 2020, according to a report from The Conference Board. Having a strong sustainability stance can help in attracting and retaining talent. A few ways organizations can activate sustainability practices to support talent acquisition and retention include:

- Setting a bold, progressive sustainability agenda that includes such elements as committing to net zero carbon emissions, setting science-based targets, piloting zero waste fit outs, establishing water efficiency standards and more.

- Providing green space, fresh air and better lighting to help promote employee safety and well-being while also bettering the environment.

- Obtaining recognizable certifications such as LEED or WELL, which, when promoted, can help show current and prospective talent that sustainability is a top commitment.

- Investing in and interacting with local communities through community groups and non-profit organizations, providing progress reports to stakeholders along the way.

Now’s the time to invest in sustainability practices.

While it's tempting to assume that other organizations, including your competitors, have moved sustainability initiatives down their list of priority projects due to the current pandemic and resulting economic climate, the reality is opposite: Organizations are maintaining or ramping up their sustainability initiatives and goals. The Conference Board surveyed more than 230 organizations across 11 industries in the spring of 2020. Nearly 70% said they have no plans to slow or shut down their sustainability program due to the pandemic, while 21.6% expect little or no impact on their program. 10.2% of those organizations actually plan to increase their overall emphasis on sustainability.

A green recovery is important for attracting and satisfying investors, to sourcing and retaining top talent and to ensuring long-term resiliency. For these reasons, most organizations are continuing with their sustainability efforts, and you should too.

Take the next step on your sustainability journey

Visit our website to learn how to accelerate your organization’s journey to become a more sustainable, more resilient and more responsible enterprise.